RENTING VS BUYING A PROPERTY

Flexibility

Can move easily and relocate around the country and abroad if needed which can save you money. Also, you can upsize or downsize properties quicker and easier if you have a growing family or group which can help situations requiring a quick change of living whereas if you own that home, you are stuck as a homeowner that can require you to sell your existing property which may result in delays, being stuck in a large chain if the property you are either upsizing or downsizing into also has a onward purchase. With 1 in 3 property sales falling through statistically, your obstacles can become even harder if the failure of the person whom they are buying a property from pulls out of the transaction.

Living in the home you own can seem un-flexible if you need to quickly upgrade or downgrade where you live if there is a change in income and things can no longer become affordable. Meaning less stress.

Cost

When moving home as a renter, your costs are lower as you

do not need to pay stamp duty which is the case where you’ll pay this You’ll pay tax on the purchase of a new main property costing more than £250,000, unless you’re a first-time buyer.

Economic Downturn

With rents going up due to landlords’ mortgage rates increasing when their fixed-rate mortgage products come to an end, this knock-on effect can cost the tenant more. Positively the tenants have a choice to leave and find cheaper accommodation, however, the landlord will be stuck with increasing mortgage rates unless they can secure a new fixed mortgage product which can be costly and also with the downsize of not making enough income to justify owning the property as that area may already have a ceiling price rental figure that is already being charged, so increasing the rent can lead to the property not being let

Security

With renting there is a notion that your security is not always guaranteed as the landlord may potentially look to sell or the house requires a refurbishment. This can be difficult if you have a family in a property and transitioning dependants into an un-welcomed move. Owning a home can give you security as you will not be asked to leave unless you fail to pay your mortgage when your home gets repossessed.

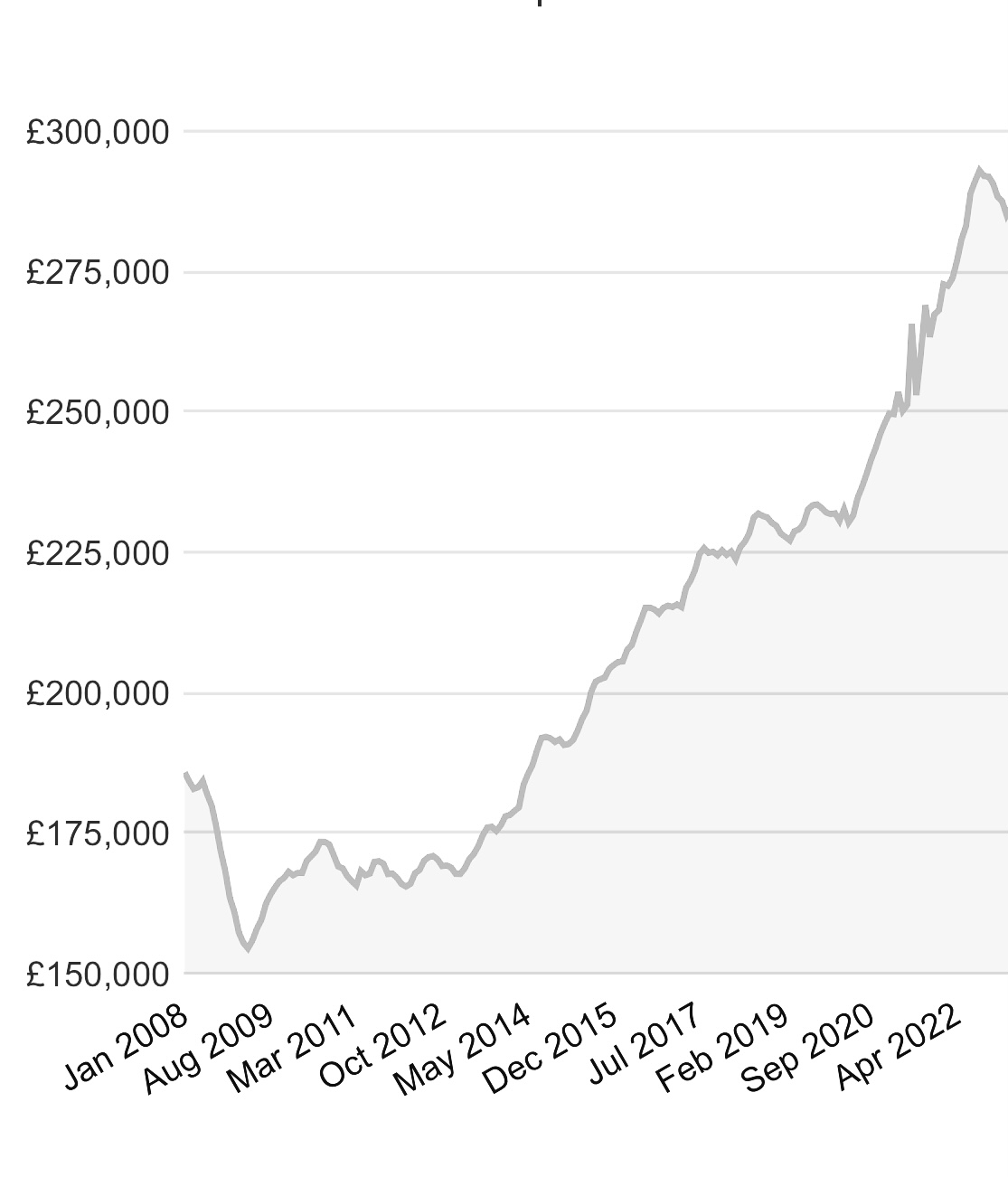

Increasing Property Values

Depending on where you live in the UK, your property is likely to grow in value, where it may fall at times but historic data shows that it has always gone up for example in 1999 the average house price was approximately £57k VS in 2020 the average house price was £250k.

No Capital Gains Tax on Primary Residence When You Sell

If you have one home you are selling to either upsize or downsize or simply sell without buying, you are a property owner and do not need to pay any capital gains tax if you have lived in that property as your main home for the whole time you’ve owned it with consideration to never letting it out or having a lodger. This can be a big bonus when your home has built up a lot of equity from capital appreciation and you are looking to retire or even upsize to a larger property with more funds in the bank.

CONCLUSION

There is no rule as to which single option is better as everyone’s circumstance is different and some may value flexibility over security. However, the motion of owning an asset is an endeavour everyone should consider even if they still rent which can reap the benefits of both worlds

Thinking of buying, selling or letting your property?

Get in touch with our team of expert property professionals to help

Property Prices Dropping by 40%? We Don’t Think So!

Mortgage Rates Increasing in the face of the Bank of England base rates increasing in order to fight inflation for ...

RENTING VS BUYING A PROPERTY

Flexibility Can move easily and relocate around the country and abroad if needed which can save you money. Also, yo ...

6 Tips for successfully preparing your property for being SOLD or LET

The key thing when marketing your property will come from how you present your home in a way that makes the buyer o ...