Property Prices Dropping by 40%? We Don’t Think So!

Mortgage Rates Increasing in the face of the Bank of England base rates increasing in order to fight inflation for some is a short-term storm they are manoeuvring through, whilst others are facing uncontrollable expenses increasing, whilst all other expenses such as energy bills, council tax hikes and cost of living struggles are adding pressure on people throughout the country.

Positively, getting through this will be difficult but the prices of people’s homes and investment properties are extremely unlikely to drop in value by 40% based on property data.

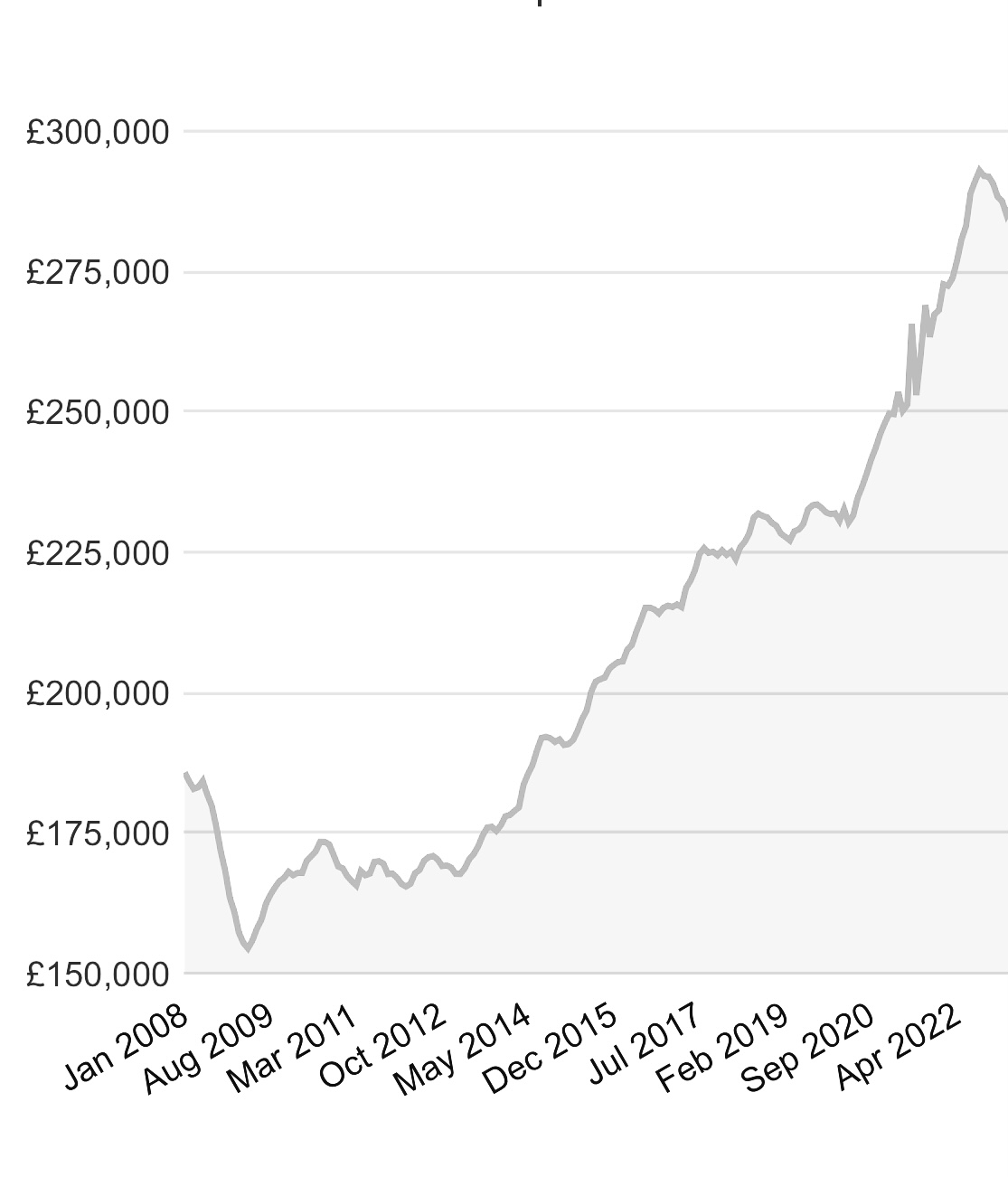

The UK average house price in 2018 was worth just over £220k. In 2023 the average is worth just over £286k from £290k, this dip has always been normal with the biggest drop within the last 15 years occurring during the 2008 to 2009 when property crashed to an average house priceof £150k! Meaning the fear-mongering news outlets who predict a 40% drop will mean the average house would be worth £170k, which it is still higher than what values went to after the Global housing recession which was a result of bad lending practices when anyone with a pen could apply for a loan.

Thinking of buying, selling or letting your property?

Get in touch with our team of expert property professionals to help

Property Prices Dropping by 40%? We Don’t Think So!

Mortgage Rates Increasing in the face of the Bank of England base rates increasing in order to fight inflation for ...

RENTING VS BUYING A PROPERTY

Flexibility Can move easily and relocate around the country and abroad if needed which can save you money. Also, yo ...

6 Tips for successfully preparing your property for being SOLD or LET

The key thing when marketing your property will come from how you present your home in a way that makes the buyer o ...