Fixed Rate Mortgages Over for More than A Million Property Owners in 2023

This year, many people will see the end of their fixed-rate mortgage. A total of almost 1.4 million property owners are in the same position. Moreover, the Office of National Statistics reports that roughly 57% of those 1.4 million people will have their two-year, 2% fixed rated mortgage deals end.

Considering the average cost of new two-year fixed rate arrangements are roughly 6%, the analysis found that a borrower with a £200,000 mortgage would see a monthly rise of £440 per month.

From the start of the year through to March, 353,000 fixed-rate mortgages will be up for renewal or move to the variable rate, another 371,000 from April through June, and the remaining in the year’s second half.

The Outlook of Interest Rates in 2023

The Bank of England Bank Rate is the standard reference for the cost of borrowing money.

After June 2023, the Bank Rate is expected to rise to 4.8%, according to the Office for Budgetary Responsibility. This independent organisation analyses the public finances of the United Kingdom. In 2024, it is expected to fall slightly by 0.3%.

This being just a prediction from economists without a crystal ball on their side, the future direction of interest rates is seen to be even harder to predict due to several factors including a European war. The Ukrainian crises adds inflationary pressures in the UK, that propels inflation through higher energy prices and oil, with a backlash on the UK economy as costs are far greater.

The knock-on effect is increasing rent prices for Tenants

A recent report by the Office for National Statistics (ONS) indicated that renters in the private sector had experienced the most significant rent increases since 2016. A quarter of renters reported an increase in their rent within six months of their tenancy. Annual rent increases averaged 4%. On average, renters spend 24% of their income on housing, whereas homeowners spend only 16%.

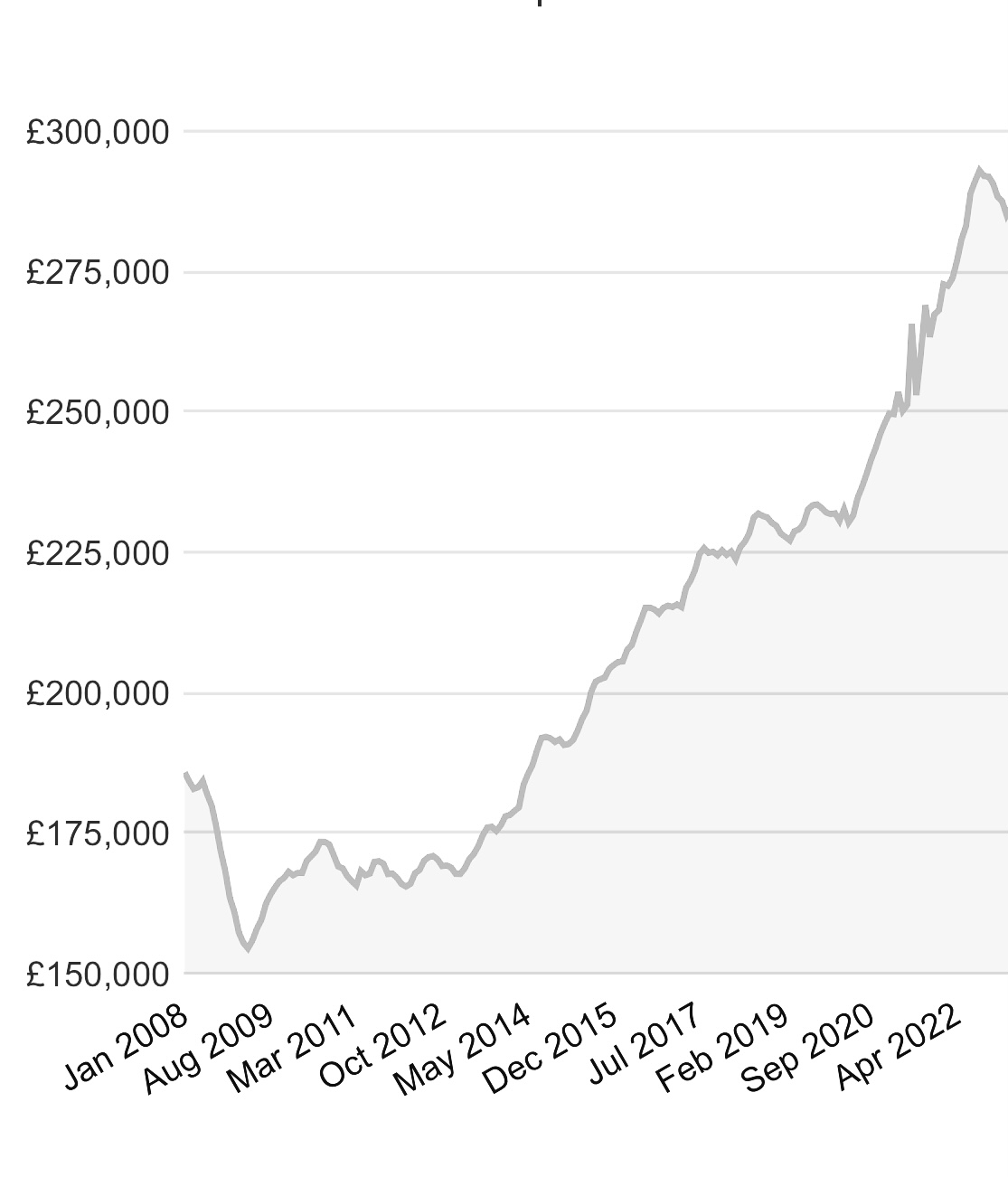

Current Mortgages market Since Kwarteng’s Mini Budget

While the Bank Rate did rise around the end of last year, the excellent news is that the cost of fixed-rate mortgages has been declining since the cost of borrowing going up from the affects of Kwarteng’s mini budget in September 2022. The value of the pound dropped resulting in the Bank of England increasing the interest rate. They did this to combat the effect of a weak pound by giving more reward to those buying sterling and saving:

“Higher interest rates make it more expensive for people to borrow money and encourage people to save. Overall, that means people will tend to spend less. If people spend less on goods and services overall, then the prices of those things tend to rise more slowly. Slower price rises mean a lower rate of inflation.” – Bank of England

The new chancellor, Jeremy Hunt, has rolled back many of his Kwarteng’s policies, and since then the pound has grown stronger.

According to Moneyfacts, the average rate imposed for a fixed-rate mortgage with a term of two years is presently 5.79 percent. The rate for a five-year fixed term mortgage is 5.63 percent.

Standard fixed-rate mortgages dropped to 5.39% on a two years fixed rate and 5.33% for five year fixed rate if you borrow 60% of your home’s value. Also, rates below 5% have been becoming more readily offered from lenders.

In conclusion, property owners that cannot justify the ownership of a home or investment property with the current new rates will have no choice but to sell leaving for a further correction in property values if buying demand falls. The ones who can benefit are first time buyers having a greater choice of properties they once couldn’t afford or Investors looking to find the next profitable investment property

Thinking of buying, selling or letting your property?

Get in touch with our team of expert property professionals to help

Property Prices Dropping by 40%? We Don’t Think So!

Mortgage Rates Increasing in the face of the Bank of England base rates increasing in order to fight inflation for ...

RENTING VS BUYING A PROPERTY

Flexibility Can move easily and relocate around the country and abroad if needed which can save you money. Also, yo ...

6 Tips for successfully preparing your property for being SOLD or LET

The key thing when marketing your property will come from how you present your home in a way that makes the buyer o ...